This article first appeared in the special edition of The State of Fashion: Watches and Jewellery, co-published by The Business of Fashion and McKinsey & Company. To learn more and download a copy of the report,click here.

With combined annual sales of over $329 billion in 2019, as estimated by McKinsey, fine jewellery ($280 billion) and watches ($49 billion) are highly significant industries in terms of their contribution to global business. They also represent meaningful cultural assets that have for centuries reflected human preoccupations with creativity, status, symbolism and self-expression. Yet today, both sectors find themselves at an inflection point.

As uncertainty caused by the Covid-19 pandemic rippled across the globe and short-circuited demand, the fine jewellery and watch industries suffered revenue declines of 10 to 15 and 25 to 30 percent respectively, according to McKinsey estimates, putting further strain on slow-to-adapt players and crystallising emerging trends in the market. Physical retail’s closure for extended periods revealed cracks in the fine jewellery and watch industries’ slow transition to digital — which lags far behind other luxury categories — with online sales representing approximately 13 percent of the market for fine jewellery and just 5 percent for watches. Meanwhile, the abrupt halt to global travel stifled fine jewellery and watch purchases made by consumers on trips abroad, which accounted for some 30 percent of the pre-pandemic market for both sectors.

While global travel is not expected to return to pre-pandemic levels much before 2024 according to McKinsey recovery scenarios, the fine jewellery and watch industries can get some of their sparkle back with a new set of rules that enable them to regain lost momentum. By 2025, we expect demand to increase from younger consumers as well as those shopping domestically, amid continuing restrictions on international travel and the rise of domestic duty-free zones in China. Already the biggest regional market, accounting for approximately 45 percent of branded global fine jewellery sales and approximately 50 percent for watches, Asia is set to expand its share even further, with China leading the way.

As part of the broader fashion industry, fine jewellery and watches share some common dynamics with luxury apparel and footwear. Yet, at the same time, the industries operate at a different pace from fashion and the direction of change is not always the same. They are set apart by different consumer behaviours, levels of brand penetration and paths to purchase, among other market dynamics. Moreover, since both the fine jewellery and watch industries have seen change accelerate throughout the pandemic, they merit a dedicated analysis that supplements our annual review of the broader fashion industry in The State of Fashion report.

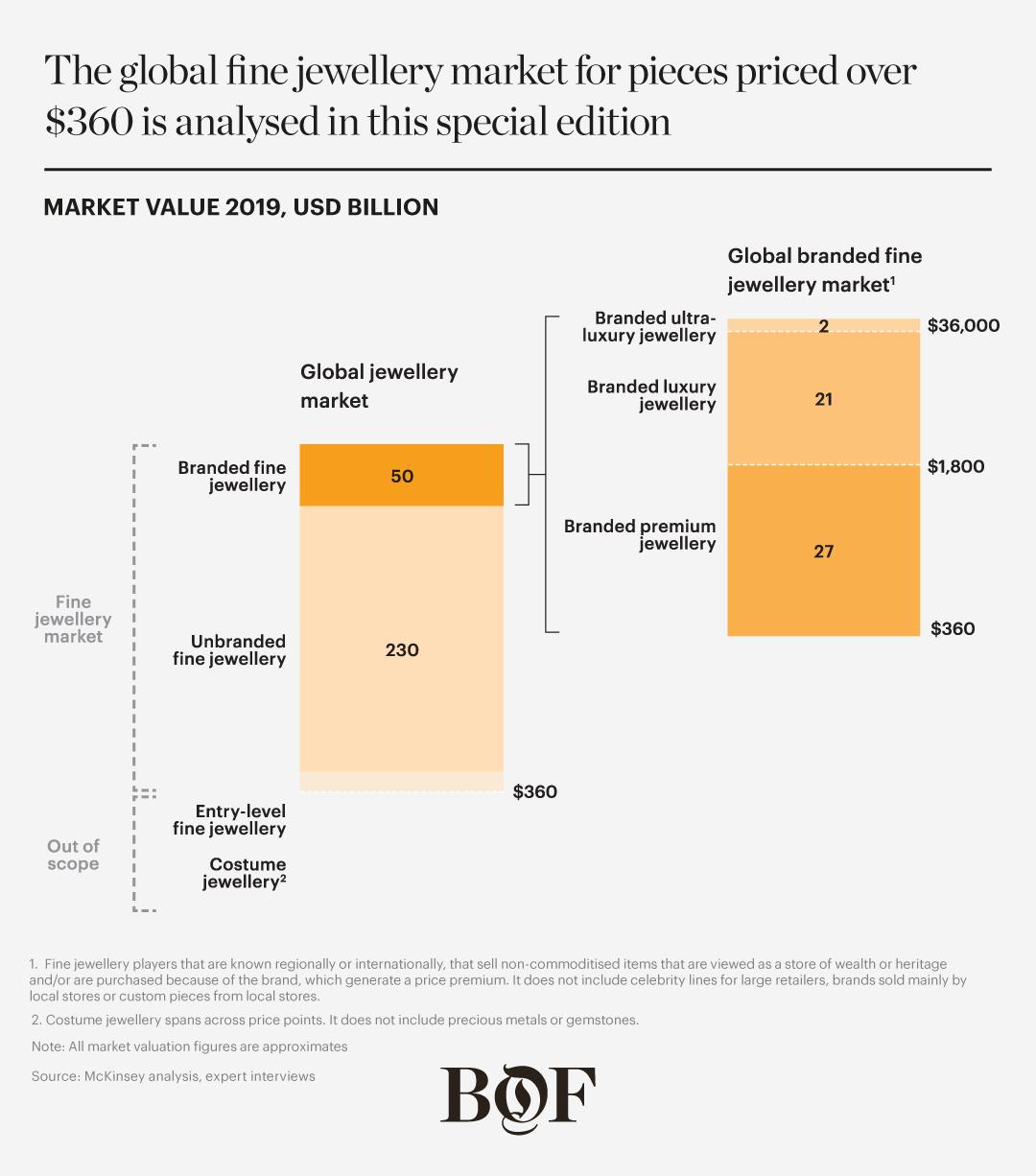

This inaugural The State of Fashion: Watches and Jewellery special edition by The Business of Fashion and McKinsey & Company analyses the driving forces behind the industries’ changing dynamics. The scope of the market analysis featured in the report covers fine jewellery above the entry-level segment — that is jewellery which contains precious metals, such as gold and silver, and precious gems and is priced over $360 — in addition to watches spanning the premium to ultra-luxury value segments, meaning those priced over $180, in which the majority of industry value lies. This excludes the entry-level watch segment which is shaped by distinctly different market dynamics.

Through executive interviews and analysis of public and private companies, market intelligence and consumer surveys, we have identified six seismic industry shifts that we believe will influence transformational change in the fine jewellery and watch industries over the next five years. These cover a variety of perspectives ranging from consumer behaviour and business models to the products themselves. The report also spotlights several additional unfolding industry shifts. While these important shifts should be on industry leaders’ agendas over the next five years, they offer less certainty in terms of their trajectories, timing and magnitude of impact on individual players.

In the fine jewellery market, a brighter future lies ahead for branded jewellery, which according to McKinsey estimates will see compound annual growth rates (CAGR) of 8 to 12 percent from 2019 to 2025. As price points in branded jewellery can be around six times higher than of unbranded products, competition between established luxury jewellery brands, fashion brands and new direct-to-consumer (DTC) companies will heat up as players compete to win customers who are turning towards brands that reflect their distinct point of view.

Meanwhile, sustainability will play an increasingly important role in buying decisions. Purchases of fine jewellery that are influenced by sustainability will more than triple in the years ahead, presenting an opportunity for the industry to learn from its history and make positive change. To show consumers that they are sincere about driving environmental and social progress, companies will need to establish more transparency and traceability in their supply chains and move beyond the performative marketing that has plagued the industry in the past.

Finally, no business leader can ignore the game-changing impact of digital transformation in the years ahead. While the jewellery industry had been slow to make the leap to online sales, the pandemic has fundamentally reset expectations for both consumers and companies. The onus will be on business leaders to create compelling online solutions that serve a clear customer need and measure up to trusted face-to-face interactions which form part of the magic of the in-person buying experience.

In the premium to ultra-luxury watch industry, McKinsey analysis predicts a slower growth rate of 1 to 3 percent each year between 2019 and 2025 (compared to branded fine jewellery’s growth at 8 to 12 percent a year) which is a symptom of structural weaknesses in the short- to medium-term. Shifting consumer demand will require brands to fundamentally rethink their go-to-market strategies. As a result of this and a broader reshuffle of deeply embedded market dynamics, approximately $2.4 billion in revenue will transfer from retailers to watchmakers as direct-to-consumer business models take centre stage. This will fundamentally upend the industry’s current structure, requiring brands to improve client serving capabilities and multi-brand retailers to search for new ways to add value.

As brands forge closer relationships with their customers, they will also find opportunities to double-dip in the revenue pool by engaging in the pre-owned market. Driven by younger consumers in addition to collectors and cost-conscious shoppers — as well as an increasingly authenticated supply on digital marketplaces — the pre-owned watch market is set to become the industry’s fastest-growing segment, reaching $29 to $32 billion in sales by 2025. With digital pre-owned marketplaces currently dominating, brands must urgently decide how they want to participate.

Finally, established mid-market players, mainly based in Switzerland, will be squeezed at both ends: by smartwatches, digitally native brands and fashion players at the bottom, and at the top by a shift in demand to higher-value segments. As a result, they will risk foregoing $2.5 billion in value by 2025. Incumbents must breathe new life into both their products and brand narratives if they are to stem this revenue erosion.

While there is little doubt that the market will continue to present tough conditions for both the fine jewellery and watch industries, the next five years also offer significant opportunities for players to rewrite the rulebook across products, distribution models and engagement strategies. The impact of the global pandemic on the fine jewellery and watch industries has only made these necessary changes more apparent. The players who anticipate and embrace these marketplace shifts can take advantage of the glimmers of light that will punctuate an otherwise cloudy recovery period.

DTC Shakeup

Offline retail has been the life source of the watch industry for decades, with multi-brand retailers owning the customer relationship. But as consumers demand better online shopping experiences and brands aim for higher margins, watchmakers will grow their direct-to-consumer channels and take control of the customer relationship through a dynamic, omnichannel approach, as $2.4 billion in annual revenues are set to transfer from retailers to brands by 2025.

Mid-Market Squeeze

The traditional mid-market for watches is feeling pressure from both sides. At the entry level there is intense competition from digital natives, fashion brands and the fast-growing smartwatch category, and at the higher end many customers are trading up to luxury. Mid-market brands must revitalise their brand narratives to differentiate themselves, refine their product offerings and create more intimate connections with consumers, or risk foregoing revenues of up to $2.5 billion by 2025.

Pre-Owned Profits

Once the preserve of private dealers and small-scale retailers, the pre-owned watch market has become increasingly attractive thanks to digitisation, which turned it into the industry’s fastest-growing segment. The market is expected to reach $29 to $32 billion in sales by 2025, which will be more than half the size of the first-hand market at the time. Brands must work hard to capitalise on this shift, and digital platforms will need to sharpen their business models in an increasingly competitive environment.

Buying Into Brands

Despite the prominence of some of fine jewellery’s biggest players, with their iconic brand identities and global reach, sales of branded fine jewellery still account for just 20 percent of the market. But by 2025, brands are set to take a bigger slice from the unbranded segment, growing to represent between 25 and 30 percent of the market. Those able to convert consumers to branded jewellery will share in the spoils of the collective $80 to $100 billion up for grabs.

Online Magic

Fine jewellery sales are traditionally associated with a bespoke service and magical in-store experiences that do not easily translate online. With online jewellery purchases surging since the pandemic, the onus is now on brands and retailers to better understand the relationship between physical and digital channels to develop enchanting experiences that capture more of the online fine jewellery market. With online sales expected to grow from 13 percent to 18 to 21 percent of the overall market between 2019 and 2025, $60 to $80 billion are at stake.

Sustainability Surge

Fine jewellery purchases influenced by sustainability considerations are poised for dramatic growth. By 2025, an estimated 20 to 30 percent of global fine jewellery sales will be influenced by sustainability considerations from environmental impact to ethical sourcing practices. But leaders in a previously slow-to-act industry must look beyond sustainability as a factor in risk mitigation and embrace it as an opportunity to build brand equity by pursuing responsible business practices.

The inaugural edition of The State of Fashion: Watches and Jewellery report co-published by The Business of Fashion and McKinsey & Companyforecasts a shake-up in priorities for hard luxury as well as different recovery scenarios across geographies and consumer segments.To learn more and download a copy of the report, click here.

BoF Professionals are invited to join us on July 13, 2021 for a special live event in which we'll unpack findings from the report.Register now to reserve your spot.If you are not a member, you can take advantage of our 30-day trial to experience all of the benefits of a BoF Professional membership.

Explore the six seismic shifts from the report:

The Future of Watches:

The Future of Jewellery:

Click hereto explore more from this special edition report, including executive interviews.