(Bloomberg) -- State-owned Life Insurance Corp. of India, with its distinctive blue and yellow logo, is ubiquitous across the country of 1.4 billion people. LIC controls nearly two-thirds of the Indian market, with about 282 million policies and more than 1.3 million agents, 100,000 employees, 2,000 branches and 1,500 satellite offices. Prime Minister Narendra Modi’s administration is racing to sell 5% of LIC in what’s set to be India’s biggest-ever initial public offering and the fourth-biggest IPO of any insurer globally. Its sheer scale presents a unique challenge for the nation’s underdeveloped capital markets, and a big test of Modi’s plan to make the economy more efficient.

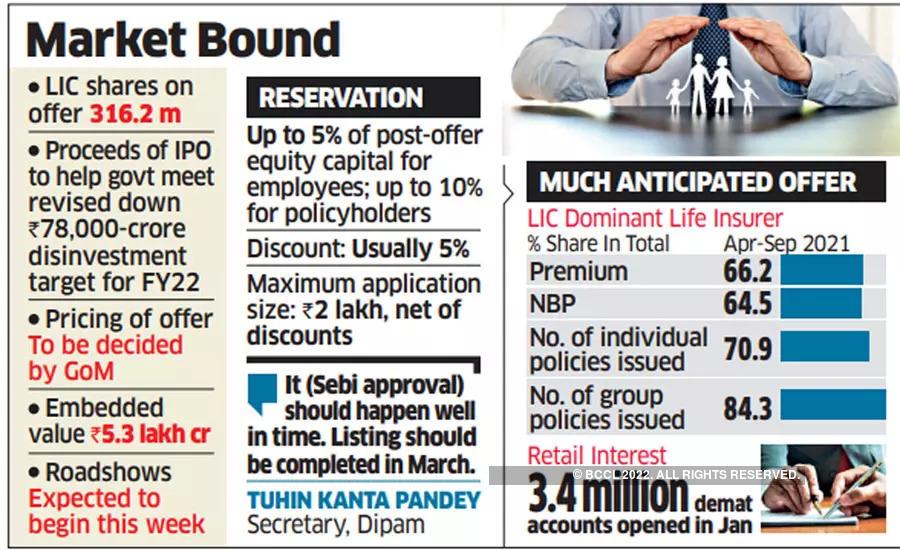

The LIC sale is the biggest chunk of a $10.4 billion asset-sale program that’s aimed at plugging India’s budget deficit for the year through March 31, 2022. The government plans to push borrowing to a record in the next fiscal year as it tries to spend its way out of the pandemic-induced downturn.

Finance Minister Nirmala Sitharaman has set a March deadline for the listing. The IPO was initially slated for the previous fiscal year, but was delayed as India’s harsh stay-at-home rules during the Covid-19 pandemic interrupted the preparations.

LIC’s size and special status make for a unique challenge. It holds almost $530 billion of assets, more than the total size of the country’s mutual fund industry. Milliman and Ernst & Young, the firms appointed to work on the valuation, have been sifting through millions of policies to account for parameters including mortalities, morbidities, lapses in premium payments and policy cancellations. They also had to weigh the value of LIC’s fixed property across its 2,000 branches. LIC releases its balance sheet only once a year, and peer-to-peer comparisons are tricky.

It’s still to be determined. A draft prospectus filed Feb. 13 put LIC’s embedded value at 5.4 trillion rupees ($71.6 billion). For an insurance firm, the total enterprise value is typically a multiple of the embedded value, taking into account demand from investors for similar listed firms. Since the government needs to raise about $8 billion to meet its asset-sale target, and it plans to sell 5% of the company, the enterprise value will need to be about $160 billion. If it hits the numbers, the IPO would surpass the biggest Indian IPO to date -- digital payments provider Paytm’s $2.5 billion listing last November.

Sales of stakes in companies so deeply entrenched in the history of their nations aren’t an everyday occurrence. LIC has exerted a towering presence over India’s financial landscape since Jawaharlal Nehru’s government combined the country’s 245 insurance companies and provident fund societies in 1956 with a mandate to offer life insurance to all sections of society. For many Indians, insurance is still synonymous with the company, even after the industry opened up to private firms two decades ago.

Some bankers are describing the sale as India’s Aramco moment. Oil giant Saudi Aramco, which staged the world’s biggest IPO in 2019, was likewise a symbol of Saudi Arabia’s economic might, generating almost 90% of the Saudi government’s income. Japan Post, whose privatization started in 2015, was the country’s biggest holder of bank deposits and its largest insurer while it ran the national postal service. Like LIC, it was highly visible, with the biggest chain of storefronts in Japan and a fleet of 86,000 motorbikes for mail delivery.

Some local investors are skeptical that the 65-year-old firm can compete against its privately owned rivals. LIC is governed by a distinct 1956 parliamentary act rather than the law governing India’s other insurers. It enjoys a sovereign guarantee of its policies, allowing it to operate with a thinner capital base than competitors. Over the years, LIC has been deployed as the investor of last resort by governments of the day to support markets and bail out other state-run companies, as in 2019 with IDBI Bank Ltd. Some bankers say global investors worry LIC could be forced to rescue other floundering state assets even after it becomes a publicly listed company.

©2022 Bloomberg L.P.

Stay Updated With QuickTakes News On BloombergQuintGet Regular UpdatesBloombergQuintJoin WhatsApp Channel BloombergQuintJoin Telegram Channel BloombergQuintGet Daily Newsletters BloombergQuintSubscribe to Notifications